Abstract

Blockchain’s current position on the technology S curve makes thisthe right time to make investments and innovate around this technology. There is a common consensus emerging that Blockchain is about five to ten years away from maturing and mass deployment. This makes ‘Now’ an ideal time for technology organizations to invest in making a firm and determined innovation based entry into the nascent blockchain market. Combining their data driven use cases with Blockchain’s known advantages like immutability, distributed architecture, concurrency and security, the early movers stand to reap exponential benefits as the technology matures. Integrated TMO (Technology, Market and Organizatio approach stands out as a structural framework of choice to making an entry into the Blockchain market.A well thought through strategy execution around Blockchain technology will not only help organizations establish leadership position in the nascent Blockchain market but will also help them develop capabilities for the future.

Introduction

Achieving ambidexterity is the key to long term, sustainable competitive advantage for organizations. As technology continues to evolve at breath taking pace, it is critical for organizations to secure a balance between their ‘explore’ and ‘exploit’ initiatives to remain relevant in the market. Blockchain, still in its infancy, promises to revolutionize the way organization and individuals’ access, consume and interac with data just as cloud has revolutionized the way data is stored. Blockchain driven ambidexterity is an exciting channel for data driven organizations to innovate in adjacent technologies and markets.

Blockchain as a technology disrupter

- “Haphazard and varied development of the initial group of products or services.

- Killer apps that emerge from a large variety of competing products.

- A slow development of the market followed by a breakout and then a rapid uptake of technology.”

Source (Bitcoin News, 2018)

Mirrored with Geroski S-Curve, Gartner’s ‘trough of disillusionment’ places Blockchain in the third phase of technology life cycle where producers of technology either shakeout or fail and investments continue based on improvements on existing technology. In the same report Gartner esmate Blockchain to achieve maturity level within the next ten years. The above trends and findings confirm two hypotheses about Blockchain:

- Blockchain has passed the initial euphoria and there are tangible benefits now visible from adoption of the technology.

- With the early adopters being shaken out and technology maturing this is now the right time to make investments into Blockchain technology with an eye on reaping the benefits within the next 5 to 10 years.

Blockchain led innovation

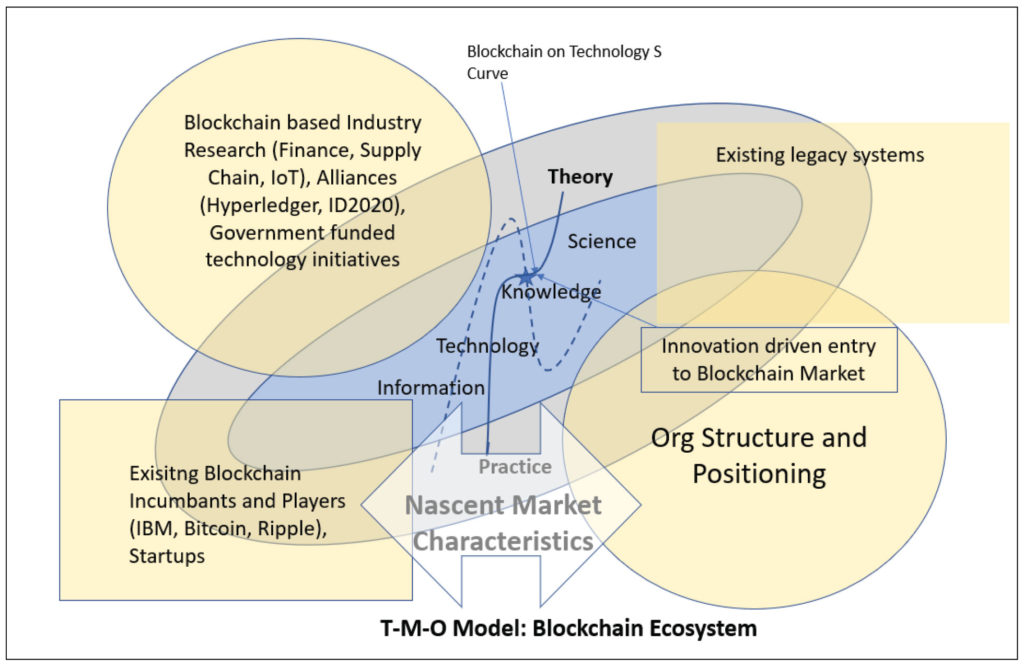

Organizations making an aggressive, determined, innovation led foray into the data driven industry segments through next generation Blockchain pillared offerings stand to gain from Blockchain’s current positioning on technology S-curve. Given the current state, an integrated Technology-Market-Organization (TMO) play with a specific strategy aimed at each of the three TMO pillars could be the right approach in Blockchain market. Further a hybrid open/closed innovation model to accelerate development of product and service offerings around Blockchain could help organizations leverage the full potential of the technology.

Integrated TMO model

Dynamic TMO framework is best suited to be applied in the case of definitive Blockchain push in technology organizations. While applying the dynamic TMO model, it is important to observe that, for innovation to have the deepest impact it will need to happen at a platform level rather than individual product or component or business unit level. This is similar to new generation firms like Apple who have gained immensely by creating platforms that they control. In looking at technology, organization and markets holistically, organizations should strive to get to the right intersection as defined by their own organizational boundary based on identity.

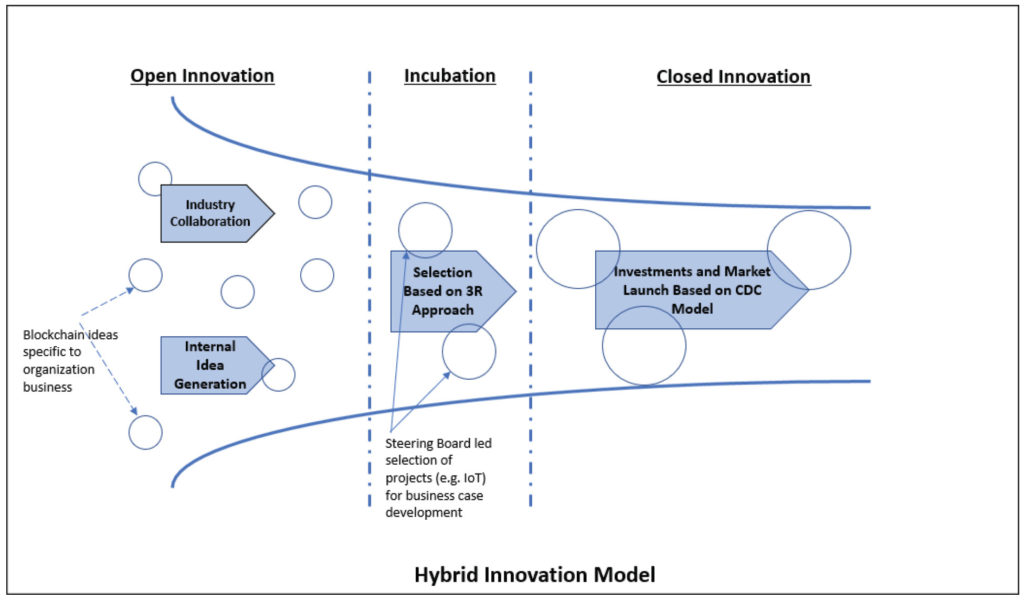

Technology

On the technology front, organizations should develop their own innovation approach drawing from the strengths offered by existing Open Innovation and Closed Innovation models. Idea generation and initial incubation should be promoted through open innovation by inviting specialized data driven bodies, universities associations and special user groups. An example of this is the Hyperledger consortium. Open Innovation should be leveraged and institutionalized within the organization so that all businesses get access and inputs from the work happening within the consortium. Even as idea generation happens within the open innovation boundary, the dominant ideas that require specific investment decisions need to be followed through on Closed Innovation channel within the firm. This is to ensure organizations focus on their industry segment as well as to retain competitive advantage. The process of selecting ideas from Open Innovation pool to investment driven Closed Innovation channel should follow a ‘act fast – fail fast’ approach similar to IDEO’s “Three “R’s” : “Rough, Rapid Right” and “Enlightened Trial and Error” (Albany.edu, 2018) approach.

Using IBM innovation jams as a model and as customized and deployed by Siemens, organizations should develop their own innovation jams through a web platform-based approach. To provide it more focus, Blockchain should be the specific topic on which innovation ideas should be solicited. These jams will enable users from different functions and product lines to come out of their siloed approach focused only on their current responsibility. Over a defined short period of time (one to two weeks) participants could submit posts on a given blockchain idea from where streams of conversation would emerge as users generate tags that characterize discussion and ideas. Siemens successfully deployed this model by creating an open innovation group within the organization and creating a platform TechnoWeb 2.0 to help channelize ideas (Lakhani et al, 2015).

Market

In many ways, Blockchain shows characteristics of a nascent market despite being around for almost a decade through cryptocurrencies. Like in all nascent markets Blockchain today has undefined industry structure (Eisenhardt, 1989a; Rindova & Fombrun, 2001), unclear or missing product definitions (Hargadon & Douglas, 2001) and a lack of dominant logic (Kaplan & Tripsas, 2008; Porac, Ventresca, & Mishina, 2002) to guide actions (Santos and Eisenhardt, 2009). The most important, and perhaps differentiating, characteristic of nascent markets is the ambiguity that prevails in such markets. Because of the absence of institutionalized patterns, it is often difficult to get clarity of vision and implications of events or situations. New firms entering the blockchain space further compound the problems related to nascent markets. These are often accompanied by fluid structure and business models. This makes it important for organizations to start by laying out the organizational boundary around their approach to Blockchain. Organizations should thus follow an idenyity-based approach to defining their boundary in blockchain space.

Organizations foray into the Blockchain market should be a well thought through claiming demarcating and controlling CDC framework. The identity mechanism illustrated by Eisenhardt and Santos (2009) to claim the market: adopt templates, signal leadership and disseminate stories could be utilized in Blockchain context by organizations to claim this nascent market. To begin with, even as an organization invest in their pilot blockchain products and offerings, their front end teams should start using well known cognitive models from other adjacent domains to convey organization’s unique identity in Blockchain. These identity building could be through easily understandable terms like ‘block factory’ or ‘data vault’. At the same time executives could start communicating to the market in a way that signals organization undisputed leadership position in Blockchain. For example, an organization could promote best practices for inputting data in Blockchain enabled systems and gain visibility through forums and conferences. Finally, organizations could invest a part of their promotion budgets in disseminating stories about their Blockchain leadership. This could be done through organizing ceremonies for introducing Blockchain enabled products and services.

As claiming establishes cognitive presence, organizations should also focus on demarcating blockchain market to achieve competitive dominance. Controlling the nascent Blockchain market will require organizations to build their own barriers to entry while increasing its own coverage. One controlling mechanism to be utilized in blockchain market could be organizations exercising so it power to subtly influence the market and its players. The form of illusion based so it power helps create a leadership image which will be helpful for organization foray into the nascent blockchain market. A consolidated approach to claiming demarcating and controlling along with a clear definition of organizational boundary will help organizations create a unique positioning in the nascent blockchain market.

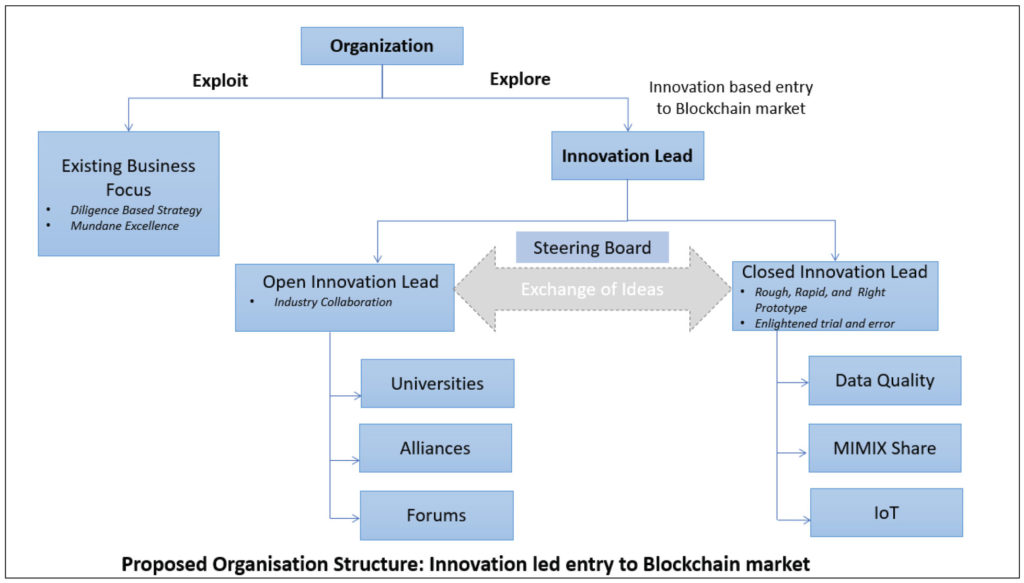

Organization

At the organization level, foray into Blockchain area will need to be a well thought thorough strategic decision rather than a tactical play. The resulting innovation model will need to be aligned to the strategy as against being routine innovation which can sometimes be myopic and short term. Given the current status of Blockchain in technology S-Curve the organization structure required to focus on this area will need to be sustainable over a period of five to ten years to be able to reap benefits from investments made today. An approach that could work in this context would be formation of two separate and distinct entities to focus on exploit and explore streams. Getting the right balance between the two streams will help organizations achieve ambidexterity between their current strategy while making a determined and aggressive claim to the market in Blockchain space. The figure below provides a proposed organizational setup to help get to ambidexterity.

On the exploit track, organizations should provide momentum to their existing activities through ‘Strategy as Diligence’. Organizations should actively seek to share activities and resources between their various divisions as well as new business acquired. Due to the dynamic nature of technology industry, where software products continuously become commodities, organization differentiation on the exploit side lies in its ability to harmoniously bring together activities that seems mundane and simple but, when taken together, forms a protective wall against imitation and makes the underlying capabilities rare. This form of mundane excellence developed over diligence-based strategy is natural choice for organizations differentiating on customer experience. In such a strategy mundane, everyday activities, like agile standups, will form the central focus in developing lasting competitive advantage.

Even as organizations pursue their strategy on the exploit front, there needs to be a separate and distinct focus on defining and executing their strategy on the explore side. The underlying organization structure needed to drive this kind of explore approach [as described in the proposed organization chart] requires a long-term commitment from senior leadership of the firm along with autonomy and supported by dedicated budgets. Building a separate explore business unit under the CTO and headed by a Chief Innovation Officer could we one possible approach to bring this focus. Within this mandate, innovation around Blockchain [refer to hybrid model proposed earlier should be split between Open Innovation Unit and Closed Innovation Unit. The Open Innovation Unit liase with external entities, developer community and alliances to bring in new ideas whereas the Closed Innovation Unit focuses on current capabilities. In addition to a closed coordination between Open and Closed Innovation Units, there should be a committee comprising of the group CEO, CTO, CFO and other leaders that would meet routinely to filter ideas from open innovation to closed innovation units. The explore unit should be given a mandate and a target to hit the market with a blockchain product in a year. This will give a tangible proof to the market of the organization interests in playing in this field beyond just R&D based press releases. The approach here should be to get a product out that is ‘good enough’ rather than ‘perfect’.

Strategy execution for blockchain explore unit

The most important guiding principle for pursuing innovation led approach needs to be its value creation potential for customers. Choosing the value that innovation will create, and then sticking to that choice, is critical because the capabilities required for the future will take time to accumulate. A parallel line can be drawn to Bell labs’ approach which was guided by the strategy to improve and develop capabilities and reliability of phone network. In the process of the journey with this strategic vision, Bell labs created multiple breakthrough innovations from telephone exchange switch to photo-voltic cell and the laser (Pisano, 2015).

Innovation is often confused, and used interchangeably, with technology innovation. In order to build lasting differentiation in blockchain field where multiple players are investing heavily in technology and product innovation, it is recommended that organizations pursue their strategy and create their value through ‘Business Model Innovation”. This will not only take an organization in the underutilized source of future value but will also make it difficult for competitors to replicate or imitate an entire activity system when compared to a single product or process (MIT Sloan Management Review, 2012). A disruptive innovation approach to complement the business model innovation as it will also challenge and disrupt the business models of other companies. For example, the Google experience with its Android operating system for mobile devices has disrupted the entire industry not so much because it is a radically different technology but because the business model around this platform is different and disruptive. This has posed a serious challenge to established players like Apple and Microsoft by creating a new ecosystem with new rules of the game (Pisano, 2015). The exploration of a disruptive business model creation in blockchain technology promises to be a differentiator.

Key Considerations

To be able to get real and tangible benefits out of an evolving technology it is important to embrace it with a long-term strategic view. Blockchain technology will not bring immediate revenues or profits as the market and ecosystem around this technology are still evolving. Further the innovation model to be pursued around Blockchain needs to have an autonomous and fairly independent existence for it to yield the necessary results. The technology is not at a stage where it can be naturally embedded into each product or project and requires a dedicated and definitive approach for organizations to be able to monetize it in the medium to long term. Several aspects of Blockchain still remain unclear at the business model end and the risks related to the unknown and ambiguous nature of the market require that organizations take a milestone-based approach to developing products and services around the technology.

Blockchain should not be looked upon as a mere technology initiative but rather a new way of doing business. The absence of immediate gains for non-technical functions need to be balanced with monitory and non-monitory incentives for all functions to embrace and propagate this technology.

Finally, going after the Blockchain technology-based market requires a change at organizational level. Change management is often a tricky area and it works best only when driven top down. For Blockchain to become successful it needs to have the support, buy in and long-term commitment from senior leadership which then needs to be dissipated within the entire organization.

Conclusion

Not since the advent of Internet has a single technology shown such promise and wide-ranging applications as Blockchain. This is a market full of ambiguity and yet opportunities. Blockchains current position on technology S-Curve makes it an ideal candidate for organizations to claim, demarcate and control this nascent market. Blockchain provides a unique opportunity for organizations to leapfrog the industry and its competitors through a well thought innovation-based strategy formulation and execution. Lasting competitive advantage for any technology organization will come from differentiating itself from its competitors and making it difficult for them to imitate or duplicate its offerings. The technology also offers a platform for technology organization to build its long-term capabilities and expertise that would then be utilized in markets of the future.

References

- Forbes.com. (2018). 10 New Blockchain Companies To Watch For In 2018. [online] Available at: https://www.forbes.com/sites/andrewrossow/2018/07/10/top-10-new-blockchain-companiesto-watch-for-in-2018 [Accessed 28 Dec. 2018].

- Albany.edu. (2018). [online] Available at: https://www.albany.edu/faculty/miesing/teaching/materials/IDEO.pdf [Accessed 27 Dec. 2018].

- Bitcoin News. (2018). Blockchain Enters “Trough of Disillusionment” According to Gartner – Bitcoin News. [online] Available at: https://news.bitcoin.com/blockchain-enters-trough-disillusionmentgartner/ [Accessed 27 Dec. 2018].

- Hyperledger. (2018). Blockchain Technology Projects – Hyperledger. [online] Available at: https://www.hyperledger.org/projects [Accessed 29 Dec. 2018].

- MIT Sloan Management Review. (2012). Creating Value Through Business Model Innovation. [online] Available at: https://sloanreview.mit.edu/article/creating-value-through-businessmodel-innovation/ [Accessed 28 Dec. 2018].

- Finance, i. (2016). Blockchain Basics: A Primer. [online] Quotidien Corporate & Crypto Finance, Blockchain Daily News. Available at: https://www.finyear.com/Blockchain-Basics-APrimer_a36196.html [Accessed 26 Dec. 2018].

- Geroski, P. (2003). The evolution of new markets.

- Lakhani, K., Hutter, K., Pokrywa, S. and Füller, J. (2015). Open Innovation at Siemens. Harvard Business School, 9-613-100.

- O’Reilly, C. and Tushman, M. (2015). Lead and disrupt.

- paper, R. and Nakamoto, S. (2008). Re: Bitcoin P2P e-cash paper. [online] Mail-archive.com. Available at: https://www.mail-archive.com/cryptography@metzdowd.com/msg09997.html [Accessed 28 Dec. 2018].

- Pisano, G. (2015). You need an innovation strategy. Harvard Business Review, pp.44-54.

- Powell, T. (2017). Strategy as Diligence: Putting Behavioral Strategy into Practice. California Management Review, 59(3), pp.162-190.

- Santos, F. and Eisenhardt, K. (2009). Constructing Markets and Shaping Boundaries: Entrepreneurial Power in Nascent Fields. Academy of Management Journal, 52(4), p.644.

- Talend Real-Time Open Source Data Integration Software. (2018). Talend CEO, Management & Leadership in Data Integration. [online] Available at: https://www.talend.com/about-us/ [Accessed 29 Dec. 2018].

- Forbes.com. (2018). The 6 Major Blockchain Trends For 2018 Outlined By Deloitte. [online] Available at: https://www.forbes.com/sites/andrewarnold/2018/07/27/the-6-major-blockchaintrends-for-2018-outlined-by-deloitte/#730c82f343a8 [Accessed 26 Dec. 2018].

- Medium. (2017). What Makes a New Market? – Mark Looi – Medium. [online] Available at: https://medium.com/@marklooi/what-makes-a-new-market-be7925c7b576 [Accessed 30 Dec. 2018].

- (Ventresca and Hajek, 2010. Technology-Market Organization (T-M-O): Strategies for Study, Policy and Action in Dynamic Technology Fields. Course Note, Saïd Business School